Invest in your future self

401(k) company matching is free money. A company that matches your contributions is in effect giving you a raise as long as you are willing to invest in your future self too. Learn about the powerful impact of company matching and continuous investments.

The impact of company matching and continuous, automatic investing on your 401(k)

Introduction

I’m going to make the case that if you are not contributing to your 401(k) each pay period you are squandering a serious opportunity to invest in your future self.

As a quick summary, a 401(k) plan is a pre-tax way to make an investment for your retirement. You designate a percentage of your paycheck to be deducted each pay period and transferred to an investment account (usually held at a company like Fidelity or Vanguard). This money is taken out before taxes are calculated, a benefit because you don’t pay income taxes on the money you direct to your 401(k) plan, effectively lowering your taxable income.

Many companies want employees to save for their future, and as an incentive, they will give you “FREE MONEY” in the form of matching a portion of the contribution you make. If you contribute to your retirement, they will contribute too. In effect, they are giving you additional money to be invested in the very same choices you designate for your pre-tax contributions. The company contribution is yours to keep once you become vested in the program

Let’s take a look at the impact that the company match has on your 401(k) return over time.

How does company matching work?

The 401(k) plan documentation from your company will provide the details of your company’s matching rule. There can be some variation on how companies match 401(k) contributions, so checking the plan documentation will give you the correct rule to apply to your personal calculations. Your company’s matching rule will likely look something like this:

There are a lot of percentages in that single sentence, so let's break it down.

To understand how powerful this is let’s build upon an example. We will assume an annual salary of $50,000 and that you elect to contribute 1% of your paycheck to your 401(k) plan. We will also assume that you get paid every 2 weeks, so there are 26 pay periods each year. At an annual salary of $50,000, your compensation works out to be $1,923 before taxes each paycheck ($50,000 divided by 26 pay periods). Now because 401(k) money is contributed pre-tax (before taxes are calculated), you would be contributing 1% of your paycheck, or $19.23, which would be directed to your 401(k) plan every two weeks (about $500 bucks a year). This is called the employee contribution.

Since you elected to contribute 1% of your paycheck, the company, in our example, will match that entire contribution (up to 3% in our assumed rule) and also contribute $19.23 per paycheck. You just doubled your 401(k) contribution because of company matching to $38.46 every two weeks.

Now that you’re seeing the benefit maybe you should elect to contribute 2% of your paycheck. If you did, the company would match that entire amount as well. In fact for the rule we’re using in our example, the company will match dollar for dollar your election up to 3%. Let’s update our formula below for a 3% election plus the 3% company match.

What we’ve modeled is the first part of the company contribution statement: “100% on the first 3%”.

Now let's turn our attention to the second half of the matching rule, "50% on the next 2%". In our example rule, if you increase your contribution to 4% or 5%, the company will match dollar for dollar on the first 3% and $.50 on the dollar for the 4% and 5% portions. Below we update our formula once again to show the benefit of electing to contribute 5% to you 401(k) each pay period.

Now sum these three figures together to determine the total per paycheck 401(k) contribution:

In our example, you may have realized that if you elect at least a 5% employee contribution you will receive the maximum employer match, which is effectively like getting 4% raise for simply investing in yourself. Now you understand the benefits of employer matching on your 401(k) contributions.

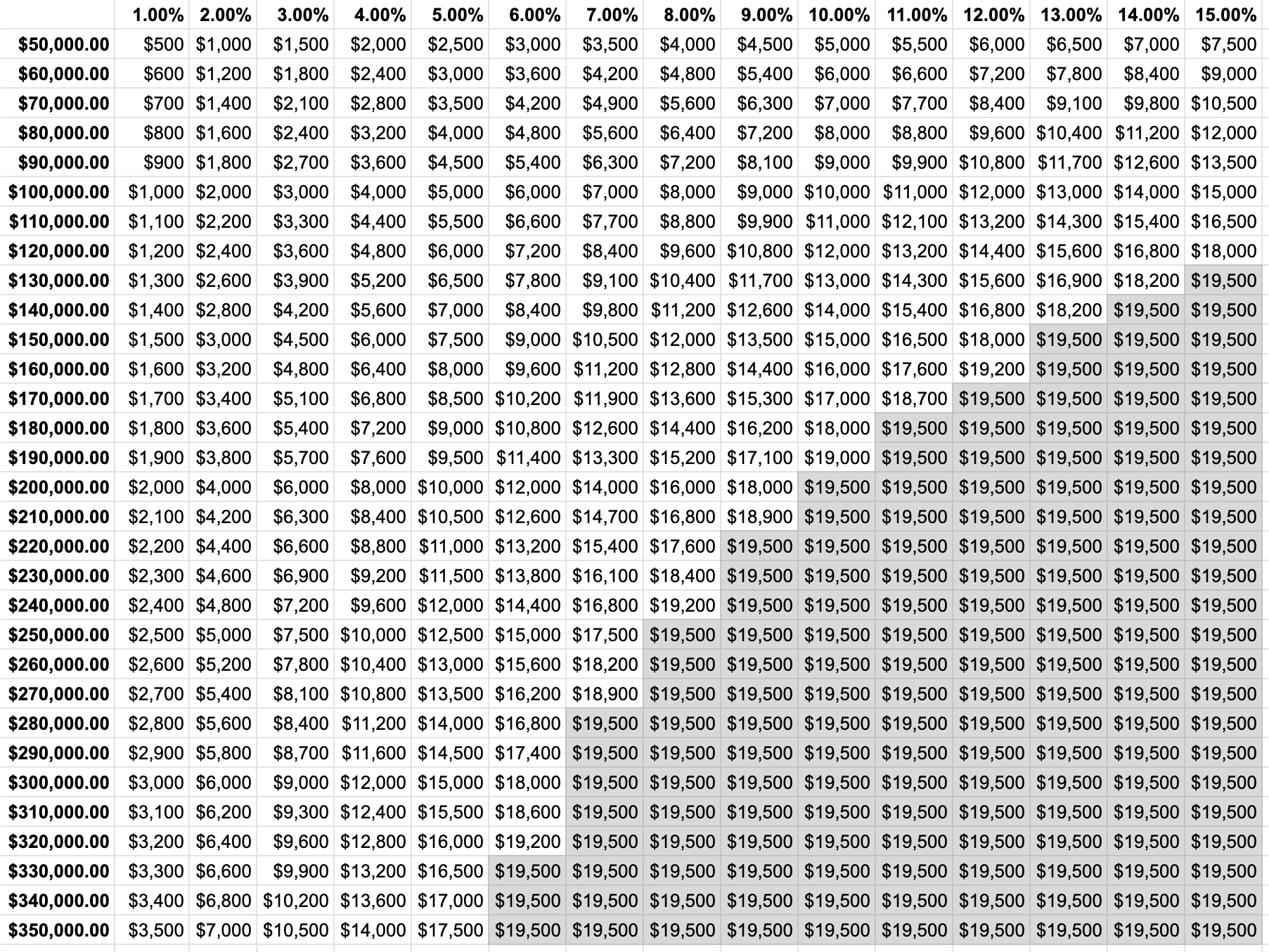

Below are a couple of charts that show the contribution amounts for both the employee and company. The first chart allows you to cross reference your salary by the contribution percentage to see how much you would contribute annually. The federal government does put a maximum employee contribution cap on 401(k) contributions, for 2021 this is an annual limit of $19,500. You will note that the boxes shaded in grey have been adjusted to not exceed the federal contribution limit in the chart below.

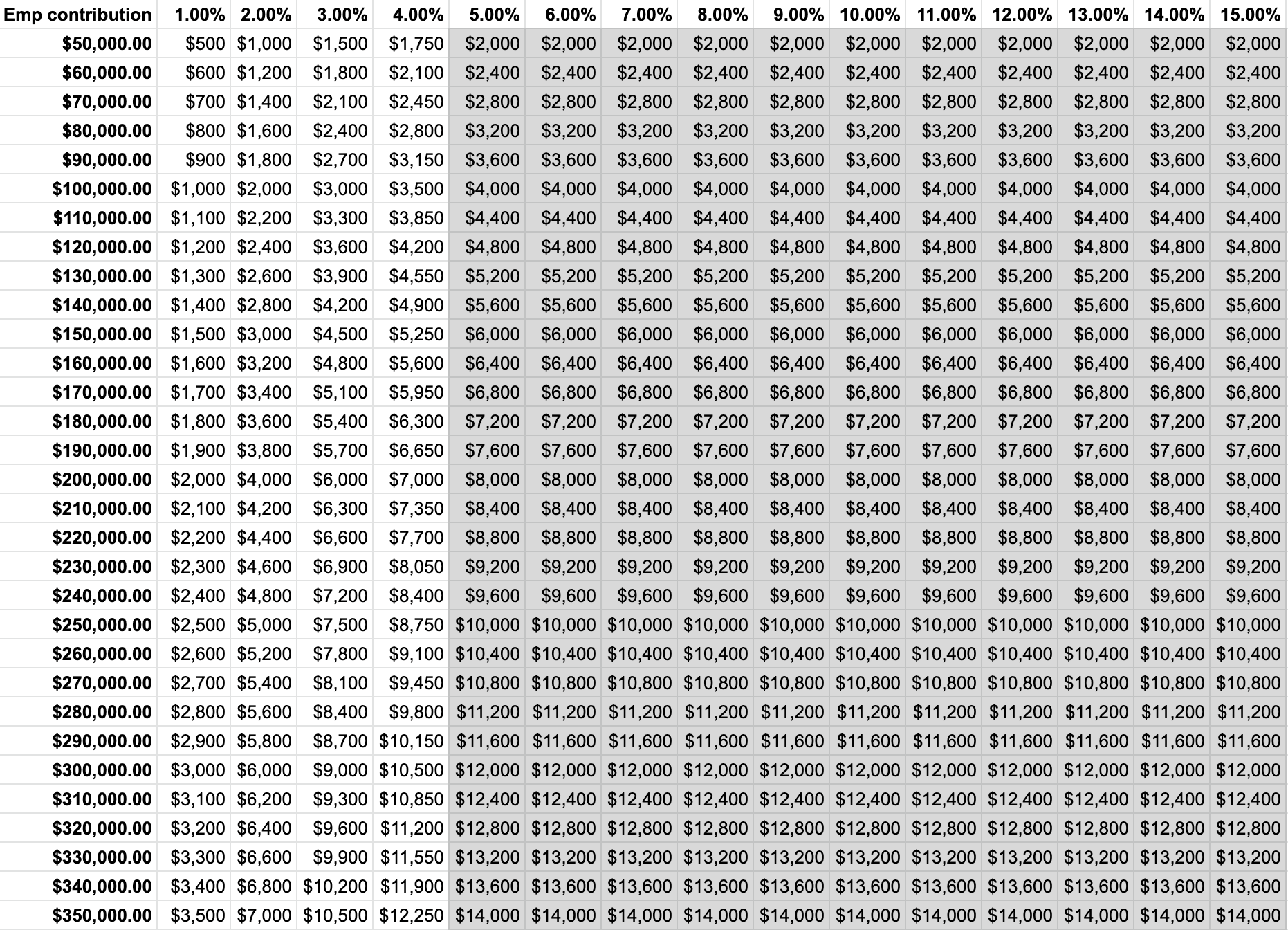

The next chart shows the annualized total from our example company matching benefit. Note the grey boxes are the maximum contribution following the “100% on first 3%, 50% on next 2%” matching rules we covered earlier.

By adding the number you get from cross-referencing both charts by your salary and the contribution election you make, you can determine your annual 401(k) contribution by simply adding the two numbers together.

For example, a person making $50,000/yr who elects to contribute 5% to their 401(k) would contribute $2,500. The company matching on this contribution would be another $2,000. For a total of $4,500.

Advantage of Continuous Investing

With an understanding of how company matches significantly improve your 401(k) contributions, let’s now turn our attention to the advantages of investing on a regular cadence. To best illustrate this we will use a simple index fund example. We will assume all of the contribution proceeds from both the employee and from the company match are contributed into a single index fund. An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a financial market index, such as in our example, the Standard & Poor's 500 Index (S&P 500).

To simplify the example we will assume that the contributions are made monthly rather than each pay period and that the contribution is made on the first day of each month. In reality your contributions are made shortly after each pay period. The table below shows the value of a share in the S&P index fund at the last trading day of each month. As you can see from the chart, the S&P index had a good year in 2019, growing a total of 28.88% overall. Only two months saw a month over month decline in value, May and August.

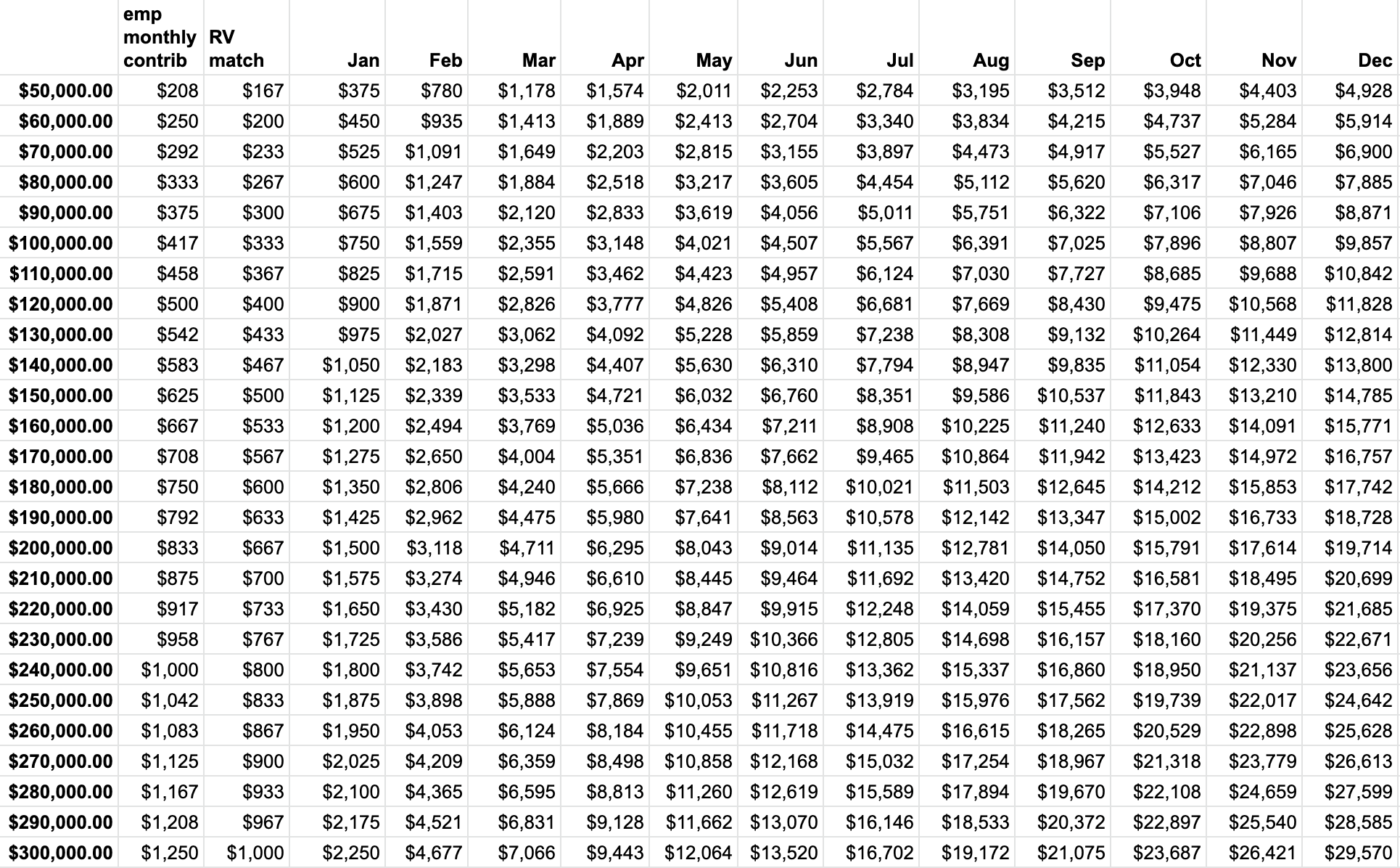

Let’s use our earlier example of an employee with $50,000 annual salary who contributes 5% to the 401(k) plan to maximize the company match. As we saw above using our employee contribution and matching charts, the employee would contribute a total of $2,500 over the year ($208 per month) and the company would contribute an additional $2,000 over the year ($167 per month). If at the end of the year the 401(k) investment did not make nor lose any money, the employee would already have a return of 80% on their employee contribution due to this match. This is already a great investment.

Since the investment in our example is made each month, let’s take a look at the impact of monthly contributions and how the S&P index fund performed over the course of 2019. On January 1, 2019 the 401(k) account would have a balance of $375 simply from the employee and company contributions. In February, the account would have a total of $780 made up of our previous balance, growth of the S&P share value over the month of January, and the new contributions from the employee and the company. In March we follow a similar formula, changing the S&P share growth to 2.97% for February 2019. The chart below applies the S&P historical data over the course of 2019 for our employee example. By the end of the year the account has grown to a total value of $4,928. The employee contributed a total of $2,500 and saw a return on this investment of 197%!

Finally, here is a chart showing the impact of the S&P index fund growth over a wide range of salaries all contributing at the 5% employee contribution amount and factoring in our example company matching. You can see the advantage of compounding investment growth over time, if you extend this over several years the impact is substantial.

Summary

Hopefully you feel well equipped to understand the significant benefit of making an employee contribution to your 401(k) that maximizes your company matching rule. The sooner you start to invest in your 401(k) the longer you will have to maximize both the company match and your investment growth.

As a reference, the S&P index has had historically had a 10% (7% when adjusted for inflation) return since inception.

While you should do your own research and consultant a financial planner for help choosing the right investment vehicle for you, you can also see the value of continuous investments and how you can take advantage of the automatic 401(k) contributions to set aside money for your future self.